Discover learning games guided lessons and other interactive activities for children. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Fraction of 1000 by which you expect your estimated deductions for the year to exceed your allowable standard deduction.

2019 california estimated tax worksheet. You can calculate your estimated taxes on the IRS Estimated Tax Worksheet found in Form 1040-ES for individuals or Form 1120-W for corporations will guide. Use the Estimated Tax Worksheet on the next page and the 2018 Form 541 tax return as a guide for figuring the 2019 estimated tax payment. To your projected total tax for 2019.

Income tax withheld and estimated to be withheld. Pay the total estimated tax by January 15 2019. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends.

In this case dont make estimated tax payments for 2019. Make your check or money order payable to the Franchise Tax Board. To calculate your estimated taxes you will add up your total tax liability for the yearincluding self-employment tax income tax and any other taxesand divide that number by four.

Enter the amount here and on line 10 of the 2019 Estimated Tax Worksheet on the next page. 2019 California Estimated Tax The 2019 Estimated Tax 2018 Estimated Tax Estimated Tax 2 10 Tax 2019 Estimated Product Estimated Quotients Tax Computation 2019 Exact And Estimated Data Estimated Products For Grade 4 2019 2 2019 Qualified Dividends And Capital Gain Tax Problem Solving Skills Estimated Or Exact Amounts 2019 51 2019 Calendars. Adjusted Gross Income Range.

Return as a guide for figuring your 2020 estimated tax. See the instructions for line 12a to see if you must use the worksheet below to figure your tax. For fiscal year estates pay the total estimated tax by the 15th day of the 1st month following the close of the tax.

How to Use Form 541-ES. Enter an estimate of your itemized deductions for California taxes for this tax year as listed in. Vouchers to pay your estimated tax by mail.

This table can only be used to report use tax on your 2020 California Income Tax Return. The 2019 Estimated Tax Worksheet. Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2018 tax return which you chose to apply toward your 2019 estimated tax payment.

For more information about Use Tax please visit. Write your SSN or ITIN and 2021 Form 540-ES on. Use the CA Estimated Tax Worksheet and your 2019 California income tax.

The 2019 Estimated Tax Worksheet by January 15 2020. Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C OR 3. Enclose form FTB 5805F Underpayment of Estimated Tax by Farmers and Fishermen with Form 541.

California Use Tax Information. Note that if have too much tax includes withheld UC you will receive a refund when you file your tax return. The Instructions for the 2019 Estimated Tax Worksheet.

Balance override if a different amount is. When figuring your required estimated tax payments you must pay the lesser of 100 percent of last years tax or 90 percent of your current years tax. If you have too little tax withheld Deductionyou will owe tax when you file your tax return.

Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2019 tax return which you chose to apply toward your 2020 estimated tax payment. File Form 1041 for 2019 by March 1 2020 and pay the total tax due. Please use the California Estimated Tax worksheet in the Instructions for Form 540-ES Estimated Tax for Individuals 540ES Form Instructions to figure your estimated tax payments.

Use 100 of the 2021 estimated total tax. The 2019 Tax Rate Schedules for your filing status Your 2018 tax return and instructions to use as a guide to figuring your income deductions and credits but be sure to consider the items listed under What. If you use the calculator you dont need to complete any of the worksheets for the UC W -4DE 4.

In this case estimated tax payments are not due for 2018. File Form 541 California Fiduciary Income Tax Return for 2018 on or before March 1 2019 and pay the total tax due. Use the CA Estimated Tax Worksheet and your 2018 California income tax return as a guide for figuring your 2019 estimated tax.

WORKSHEET B ESTIMATED DEDUCTIONS 1. The Lookup Table below may be used to pay estimated use tax for personal items purchased for less than 1000 each. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

2019 Tax Computation WorksheetLine 12a k. Refund from prior year designated as an estimated payment. Number of allowances for Regular Withholding Allowances Worksheet A.

Use Estimated Tax for Individuals Form 540-ES 12. Discover learning games guided lessons and other interactive activities for children. Mental Health Services Tax Multiply line E by line F.

Use 100 last years amount from the line above. Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2016 OR 2.

Certified Tax Resolution Specialist James Cha From Ace Plus Tax Resolution Advises Non Filers To File Their Back Tax Returns Now Send2press Newswire Estimated Tax Payments Tax Deadline Payroll Taxes

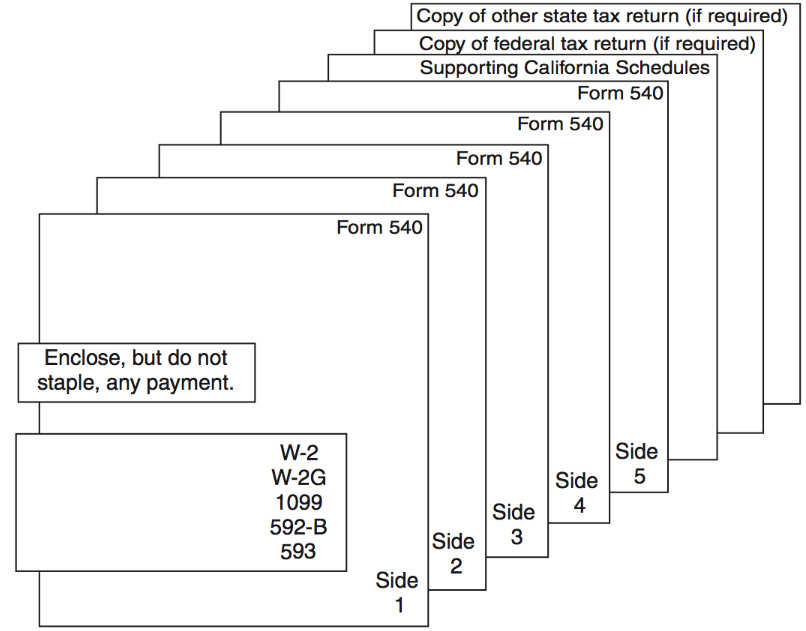

Irs Form 540 California Resident Income Tax Return

Form 1065 Other Deductions Worksheet Deduction Tax Credits Estimated Tax Payments

Employment Separation Notice Template Inspirational Ga Dol 800 Form 2005 2019 Fillable Printable Line Notice Template Templates Notes Template

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

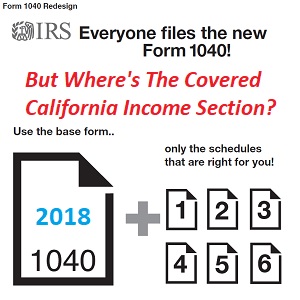

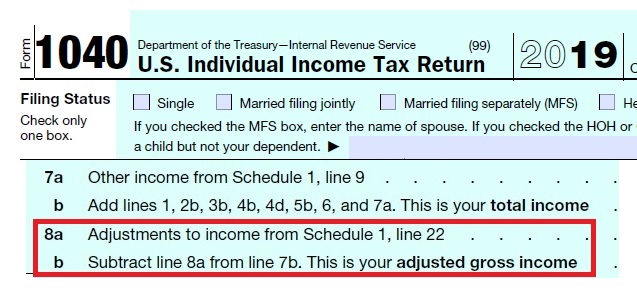

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

Pin By Joanne Sweet On Budget Budgeting Worksheets Nevada

2021 Federal Tax Brackets What Is My Tax Bracket

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Taxes For The Self Employed How To File The Perfect Income Tax Return Youtube Income Tax Return Estimated Tax Payments Tax Forms

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

California Tax Forms H R Block

Room Rental Agreement California Free Form Inspirational Free California Rental Lease Agreemen Rental Agreement Templates Lease Agreement Room Rental Agreement

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

No comments:

Post a Comment