Since the changes were enacted in May 2017 tax practitioners nationally have been seeking elusive guidance as to how these rules affect their clients. A franking account records the amount of tax paid that a franking entity can pass on to its membersshareholders as a franking credit.

Impact Of Proposed Legislation Franking Credits Capital Partners Private Wealth Advisers

Resource of Australian Tax and Accounting materials including Legislation Rulings Cases Commentary Practice Aids and News.

Franking account worksheet 2018. Franking Account Entries Consequences of over-franking The franking credit attached to the distribution will remain valid for the recipient shareholder ie. A franking account tax return must be lodged where the franking entity is liable to pay franking deficit tax or over-franking tax or where its obliged to disclose to the ATO a significant variation in its benchmark franking percentages. Include franking credit in assessable income and obtain tax offset for franking credit.

Credits on to its shareholders these franking credits may be wasted. A franking account records the amount of tax paid that a franking entity can pass on to its members as a franking credit. The franking credit attached will still be a debit in the companys franking account.

This means the dividend before company tax was deducted would have been 1000 700 300. Print one letter or number in each boxor specify period if part year or approved substitute period. ATO imputes or allocates or assigns or credits the franking credit to each shareholder and reduces the companys franking account by the same amount.

Lets assume that your marginal tax rate is 45 percent plus a medicare levy 15 total tax rate is 465. The total over-franking amount integrates to Section B Label D in the Franking Account Tax Return. This worksheet calculates the over-franking tax using the formula.

N a liability to pay franking deficit tax FDT n a liability to pay over-franking tax OFT or n an obligation to notify the Commissioner of Taxation in. When a company is deemed to have paid a dividend under Division 7A ITAA 1936 the amount of the debit in the franking account will be the amount of the deemed distribution franked at the companys benchmark franking percentage for the period. The Franking account tax return 2017 must be completed for all Australian corporate tax entities and New Zealand franking companies that have.

Franked dividend paid by FQ Pty Ltd on 15 November 2016 Franking Account debit 7000001-tax ratetax rate Franking account balance 30 June 2017. Per the example in Table 2 we note that under the new imputation rules while 30 of company tax paid in 2015-16 is credited to the franking account this balance is only reduced by an amount of 2655 being franking credits distributed to the resident shareholder. The franking percentage for this distribution is calculated as.

Franking account tax return and instructions 2018. 700000 300000 0. Franking credit formula.

His dividend statement says there is a franking credit of 300. This represents the tax the company has already paid. Each entity that is or has ever been a corporate tax entity has a franking account.

The franking credit is calculated from the Franked amount entered in the previous field. 700000 265517 34483. Once the Franking credit has been calculated by the system if the Franked amount needs to be changed then both the Franked amount and the Franking credit fields.

Each entity that is or has ever been a corporate tax entity has a franking account. The new suite of tax cuts and fundamental changes to how franking credits are calculated took effect on 1 July 2016 but became law a mere six weeks before year end. ToDo not use correction fluid or tape.

The franking period for a private company is the same as its financial year. A x B x C C-1 Where. FQ Pty Ltd Franking account credit and balance for YE 30 June 2016.

An entity is considered a franking entity if it is a corporate tax entity. When shareholders complete their tax returns they add the 70 of dividend to the 30 of franking to declare the 100 of taxable income in this form here. With the franking calculation above we can see the benefits of the dividend imputation system.

Marlyn Pty Ltd allocates franking credits of only 3000 to the distribution rather than the 5000 maximum allowable in its circumstances. Freds assessable dividend for YE 30 June 2017. The 100 of company.

A the franking differential percentage B the frankable distribution amount C the corporate tax rate. Come tax time James must declare 1000 the 700 dividend plus the 300 franking credit in his taxable income. On 30 June 2018 Marlyn Pty Ltd distributes 11667 to its shareholders.

Total cash dividend X 3070 assuming corporate tax rate of 30. Franking account tax return 2018 Please print neatly in BLOCK LETTERS DayMonthYear DayMonthYearwith a black or blue ballpoint pen only.

Franking Account Notes Tabl2751 Business Taxation Franking Accounts Franking Account Entries Date Particulars Surplus In Franking Account On 30 June Course Hero

Consolidated Trust Distributions Ctd Ps Help Tax Australia 2020 Myob Help Centre

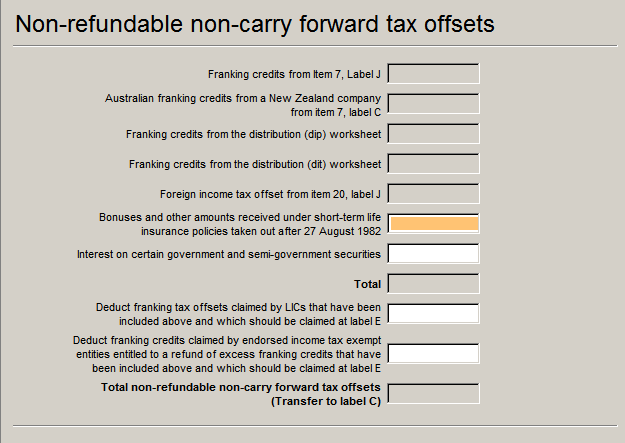

Non Refundable Non Carry Forward Tax Offsets Worksheet Nro Ps Help Tax Australia 2018 Myob Help Centre

Interest Income Worksheet Int Individuals Ps Help Tax Australia 2020 Myob Help Centre

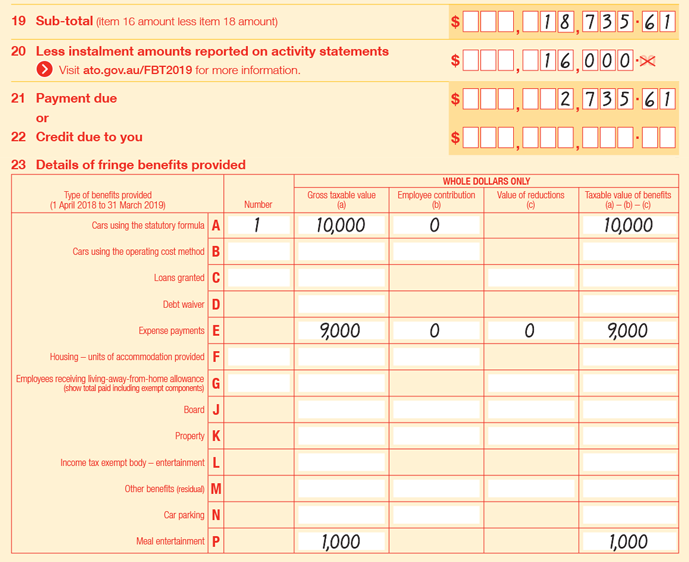

2019 Fbt Return Calculation Details Taxable Employers Australian Taxation Office

Refund Of Franking Credits Standalone Short Form Ps Help Tax Australia 2018 Myob Help Centre

How To Use The Share Register Franking Account Lodgeit

It5 Financial Investment Income And Deductions Fil Ps Help Tax Australia 2018 Myob Help Centre

Small Business Entity Aggregated Group Turnover Worksheet Sat Ps Help Tax Australia 2018 Myob Help Centre

Gross Dividends Worksheet Div Ps Help Tax Australia 2020 Myob Help Centre

Refund Of Franking Credits Standalone Short Form Ps Help Tax Australia 2018 Myob Help Centre

Franking Account Worksheets Ps Help Tax Australia 2018 Myob Help Centre

Franking Deficit Tax Offset Worksheet Fdt Ps Help Tax Australia 2018 Myob Help Centre

Https Www Ato Gov Au Uploadedfiles Content Ind Downloads Franking Account Tax Return 2017 Pdf

Franking Account Worksheets Ps Help Tax Australia 2018 Myob Help Centre

Other Income Category 1 Worksheet Oiy Ps Help Tax Australia 2018 Myob Help Centre

Franking Account Worksheets Ps Help Tax Australia 2018 Myob Help Centre

Franking Account Worksheets Ps Help Tax Australia 2018 Myob Help Centre

No comments:

Post a Comment